Managing multi-generational wealth has evolved far beyond spreadsheets and manual data entry. As family offices globally manage over $5.9 trillion in assets, the need for sophisticated software solutions has never been more critical. Despite this, 57% of family offices still heavily rely on Excel spreadsheets, leaving significant room for digital transformation.

Modern family office software has transformed from basic accounting systems into comprehensive wealth management platforms that integrate artificial intelligence, automated portfolio management, and advanced security features. This guide compares the leading solutions to help you make an informed decision.

Why Family Offices Need Specialized Software

The 2024 Family Office Operational Excellence Report shows a clear pattern: 40% of family offices are bogged down by spreadsheet-heavy workflows, and another 38% cite manual data aggregation as a major operational hurdle.

Today’s family offices require platforms that can handle complex multi-asset portfolios, alternative investments, multi-entity accounting, and provide real-time reporting while maintaining bank-level security.

The best solutions offer automated data aggregation from multiple custodians, comprehensive reporting across asset classes, and secure document management. They reduce manual work and human error.

Top Family Office Software Solutions for 2025

1. Reglu

Best For: Family offices, wealth managers, and UHNW individuals seeking unified asset management with maximum privacy

Pricing: Flexible pricing based on modules, number of users, and portfolio volume

Features:

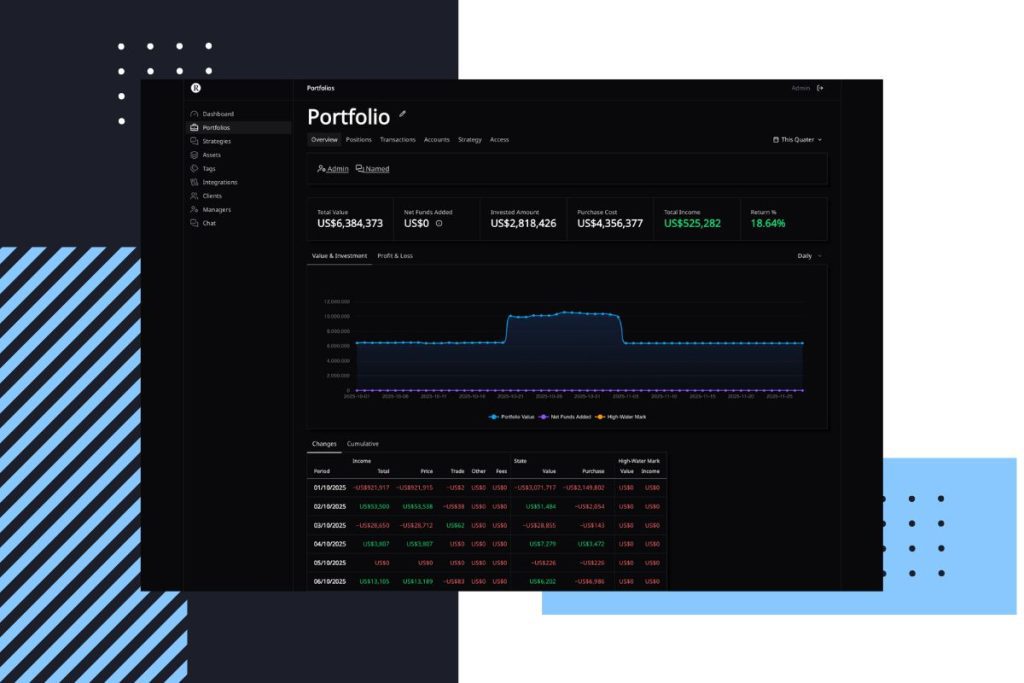

- Comprehensive Portfolio Management: Consolidate assets into operational portfolios, compare returns, monitor exposure, and rebalance with data-driven insights

- Multi-Source Data Integration: Automatically connects with various broker systems to fetch real-time portfolio information, eliminating manual spreadsheet work

- Strategic Asset Allocation: Define target portfolio structures and manage them effectively with built-in strategy modules

- Real-Time Performance Dashboard: Track key metrics and get complete portfolio analytics in one centralized view

- AI-Driven File Manager: Organize and access sensitive documents alongside financial data with intelligent upload

- Asset History Tracking: Monitor the history and value evolution of each asset over time

- Role-Based Access Control: Granular permission management allowing precise control over who can view, edit, or manage portfolios

Reglu is a true all-in-one solution that unifies asset management and strategic oversight in a single secure platform. The system creates a real-time source of truth by integrating data from multiple investment platforms, eliminating the fragmentation that plagues many family offices. Whether managing complex multi-generational wealth structures or overseeing diverse client portfolios, users benefit from consolidated views that provide clarity across all holdings.

The platform’s modular approach allows family offices to customize their implementation based on specific needs, from basic portfolio tracking to sophisticated multi-portfolio analytics with custom tagging and categorization.

For family offices transitioning from spreadsheets or seeking to consolidate multiple disconnected tools, Reglu offers comprehensive onboarding, training, and ongoing support to ensure smooth adoption and maximum value realization.

2. Asora

Best For: Modern family offices seeking comprehensive automation, mobile accessibility, and transitioning from spreadsheets

Pricing: Tier-based pricing starting at €800/month ($900/month)

Features:

- Automated data feeds from major financial institutions including Goldman Sachs, JP Morgan, Credit Suisse, and Morgan Stanley

- Digital on-demand reporting accessible via web and mobile platforms

- Built for both single and multi-family offices

Asora is a good choice for family offices transitioning from spreadsheets to a comprehensive digital platform. The software provides a single source of truth for all wealth data, eliminating the need to log into multiple portals. Its user interface emphasizes straightforward navigation while offering sophisticated features for tracking both bankable and private assets.

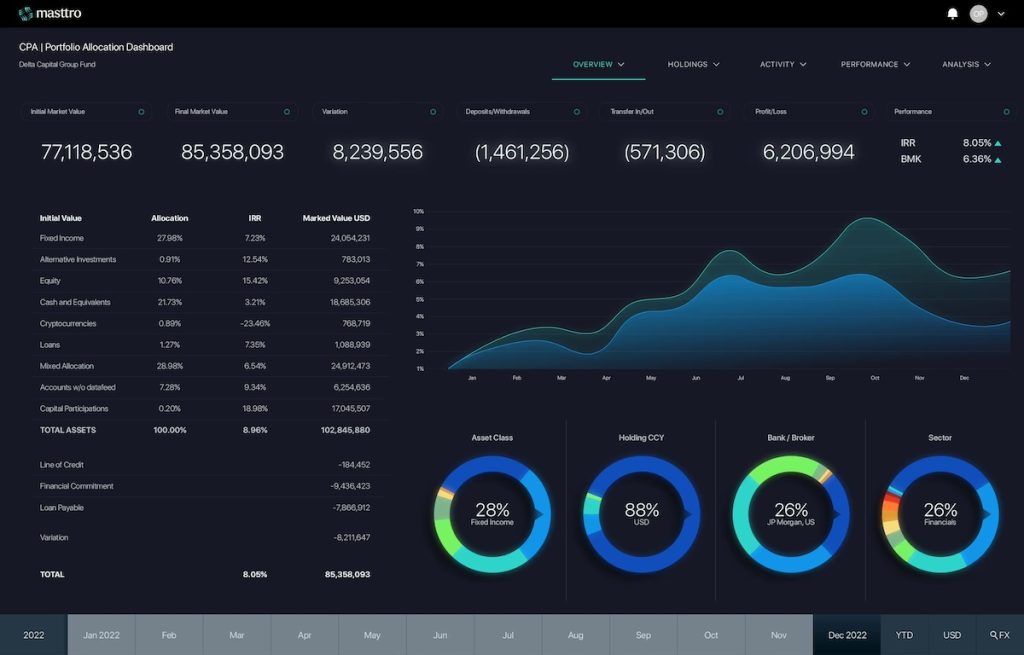

3. Masttro

Best For: Family offices with significant alternative asset holdings and complex ownership structures

Pricing: Flat-fee subscription model independent of assets under management

Features:

- Wealth Map Visualization showing detailed ownership structures

- Comprehensive support for liquid and alternative assets including private equity, real estate, and passion assets

- Zero-access security model with military-grade encryption

Founded in 2010 by family office professionals, Masttro was built to address real-world financial reporting challenges in multi-generational family offices. The platform excels at providing a complete picture of family wealth across all corners of a portfolio, making it ideal for offices with diverse asset types.

4. Addepar

Best For: Large family offices and RIAs requiring sophisticated analytics

Pricing: Based on family office size

Features:

- Real-time investment tracking for both public and private assets, including hedge funds and private equity

- Advanced scenario modeling and forecasting capabilities

- Customizable reports and dashboards for in-depth analysis

- Strong integration with third-party platforms

Addepar has established itself as a comprehensive wealth management platform with extensive coverage of financial assets and liabilities. Its strength lies in providing detailed analytics and collaborative features that facilitate teamwork in investment analysis and decision-making.

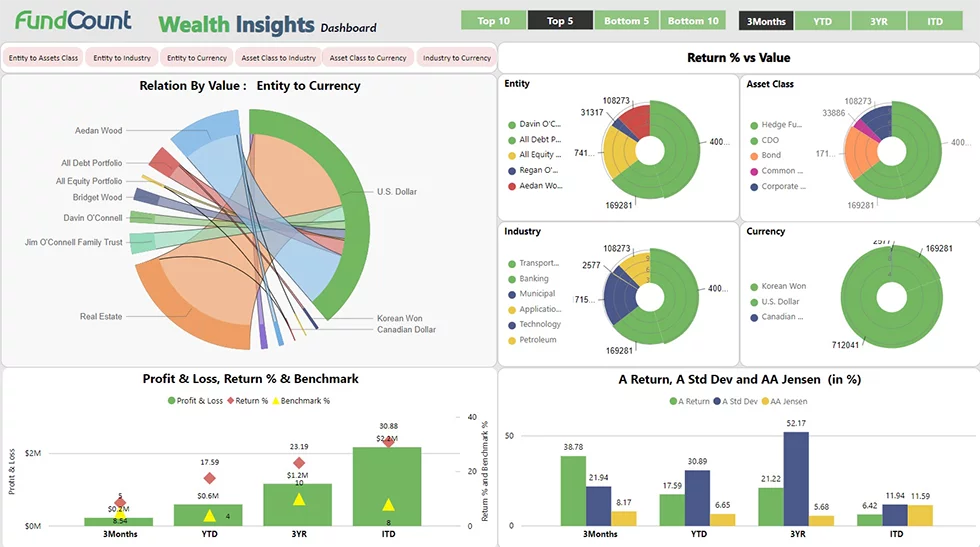

5. FundCount

Best For: Family offices with complex international holdings

Pricing: Based on number of custodians, portfolios, legal entities, and assets

Features:

- Multicurrency accounting and tax reporting

- Partnership and portfolio accounting

- Compliance tools and robust financial reporting

- Integrated general ledger with automated workflow

FundCount specializes in accounting and financial reporting for family offices with intricate investment structures. The platform is particularly suitable for offices with extensive international operations requiring multicurrency support.

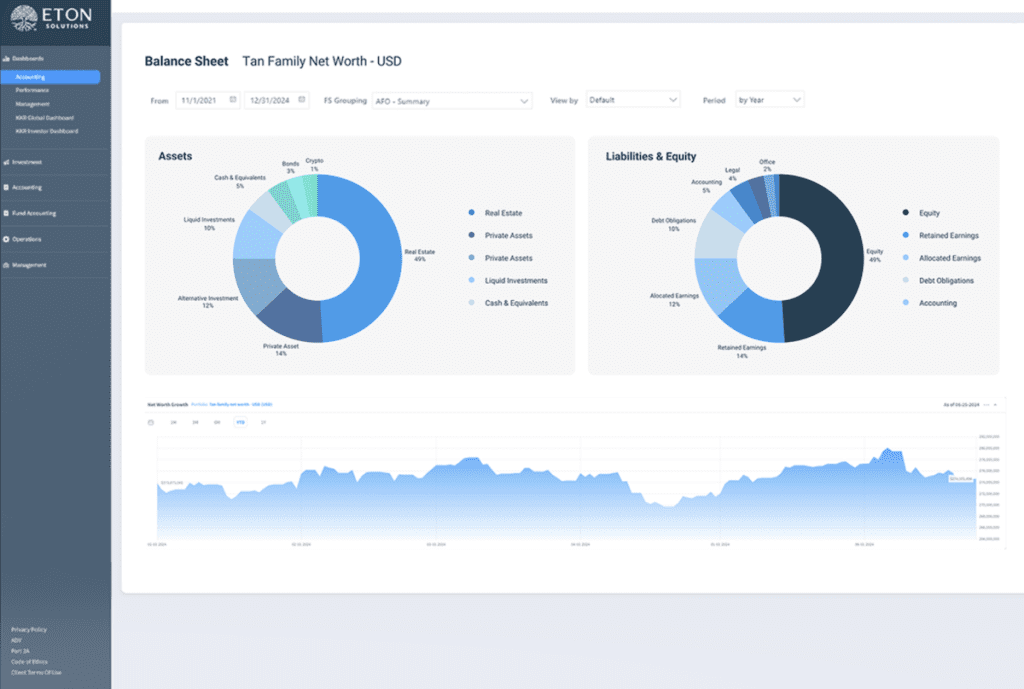

6. Eton Solutions (AtlasFive)

Best For: Family offices wanting integrated efficiency and transparency

Pricing: Custom pricing

Features:

- Reimagines family office processes into one integrated platform

- AI-powered features

- Mobile app reporting

- Banking provider integrations

Eton’s AtlasFive platform focuses on optimizing efficiency, increasing transparency, and maximizing accuracy by transforming each intricate family office process into integrated workflows.

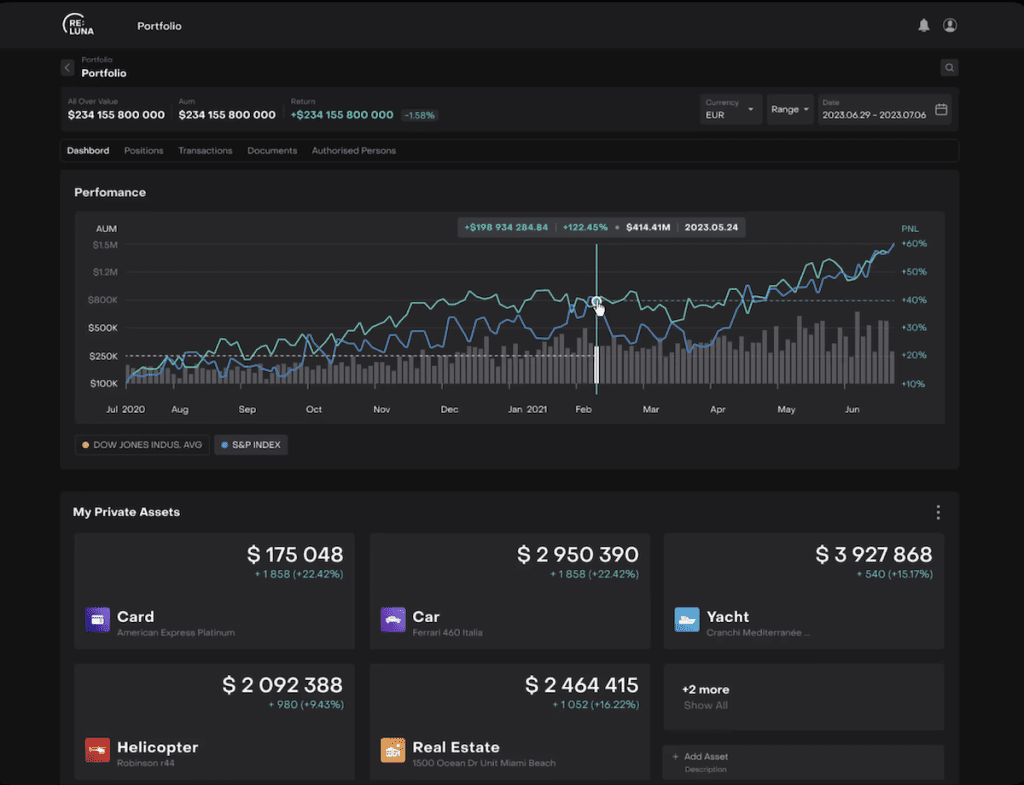

7. Reluna

Best For: Family offices prioritizing real-time data and ease of use

Pricing: Custom pricing

Features:

- Real-time analytics and comprehensive analytics

- Robust API integrations

- Superior data visualization

- Intuitive interface for managing complex family structures

Reluna has gained recognition for its powerful real-time data aggregation capabilities and comprehensive analytics across diverse portfolios. The platform’s intuitive design simplifies the management of complex family structures while ensuring transparency.

Making Your Decision

Selecting the right family office software requires a strategic approach:

- Assess Your Current State: Evaluate existing workflows, pain points, and technology infrastructure

- Define Your Requirements: List must-have features based on your asset types, reporting needs, and compliance requirements

- Consider Growth Trajectory: Choose a platform that can scale with your family office

- Request Demos: Test platforms hands-on to evaluate user experience and functionality

- Check References: Speak with current clients in similar situations

- Evaluate Support: Assess the quality of customer support, training resources, and implementation assistance

Why Reglu

Unlike rigid, one-size-fits-all platforms, Reglu is built to adapt. You can shape it around your workflows, reporting needs, and the way your team actually operates. Whether it’s custom data fields, tailored dashboards, or specific integration requirements, we work with you to configure the platform exactly the way you need it.

What’s even more important is that Reglu genuinely welcomes feature requests. If your family office needs something that isn’t available yet, you can collaborate directly with our product team to build it. The platform evolves with you, instead of forcing your processes into someone else’s limitations.

For family offices with unique structures or more complex requirements, this level of flexibility makes a real difference.